Nvidia Quarterly Earnings - Date And Time

What is NVIDIA Earnings Time? NVIDIA earnings time refers to the scheduled period when NVIDIA Corporation, a leading designer of graphics processing units (GPUs), releases its quarterly financial results.

It is a highly anticipated event for investors, analysts, and the financial community as it provides insights into the company's performance, revenue, and profitability.

NVIDIA's earnings time is important for several reasons. First, it allows investors to assess the company's financial health and make informed investment decisions. Second, it provides analysts with data to evaluate NVIDIA's progress and make recommendations to their clients. Third, it gives the financial community an opportunity to gauge the overall health of the technology sector.

NVIDIA's earnings time is typically held after the market closes on a Thursday, with the results released via press release and a conference call with analysts. The company usually reports its revenue, earnings per share (EPS), gross margin, and other key financial metrics. NVIDIA also provides forward-looking guidance for the upcoming quarter, which investors use to make projections about the company's future performance.

In recent years, NVIDIA's earnings time has become increasingly important as the company has grown into one of the world's largest semiconductor companies. The company's GPUs are used in a wide range of applications, including gaming, data centers, and artificial intelligence. As a result, NVIDIA's earnings are closely watched by investors and analysts alike.

Key Aspects of NVIDIA Earnings Time

Revenue

Revenue is the total amount of money that NVIDIA generates from the sale of its products and services. It is a key indicator of the company's overall financial health and is closely watched by investors.

Earnings Per Share (EPS)

EPS is a measure of how much money NVIDIA earns per share of its common stock. It is calculated by dividing the company's net income by the number of shares outstanding.

Gross Margin

Gross margin is a measure of how much profit NVIDIA makes on each dollar of revenue. It is calculated by dividing the company's gross profit by its revenue.

Forward-Looking Guidance

Forward-looking guidance is NVIDIA's estimate of its financial performance for the upcoming quarter. It is based on the company's current expectations and is used by investors to make projections about the company's future performance.

The Importance of NVIDIA Earnings Time

NVIDIA's earnings time is important for several reasons. First, it provides investors with a snapshot of the company's financial health. This information can be used to make informed investment decisions.

Second, NVIDIA's earnings time provides analysts with data to evaluate the company's progress. This information can be used to make recommendations to clients.

Third, NVIDIA's earnings time gives the financial community an opportunity to gauge the overall health of the technology sector. This information can be used to make investment decisions and to develop strategies for the future.

NVIDIA Earnings Time

NVIDIA earnings time is a highly anticipated event for investors, analysts, and the financial community. It provides insights into the company's financial performance, revenue, and profitability, which are crucial for informed decision-making.

- Revenue: Total sales generated from products and services.

- Earnings Per Share (EPS): Earnings per share of common stock.

- Gross Margin: Profitability per dollar of revenue.

- Forward-Looking Guidance: Company's financial estimates for the upcoming quarter.

- Analyst Expectations: Consensus estimates from analysts.

- Market Reaction: Stock price movement following the earnings release.

These key aspects collectively provide a comprehensive view of NVIDIA's financial health, industry trends, and future prospects. By analyzing revenue growth rates, EPS performance, and gross margin trends, investors can assess the company's financial stability and growth potential. Forward-looking guidance offers insights into the company's expectations for the upcoming quarter, while analyst expectations reflect market sentiment. Finally, market reaction gauges investor confidence and provides a glimpse into the company's overall standing within the industry.

Revenue

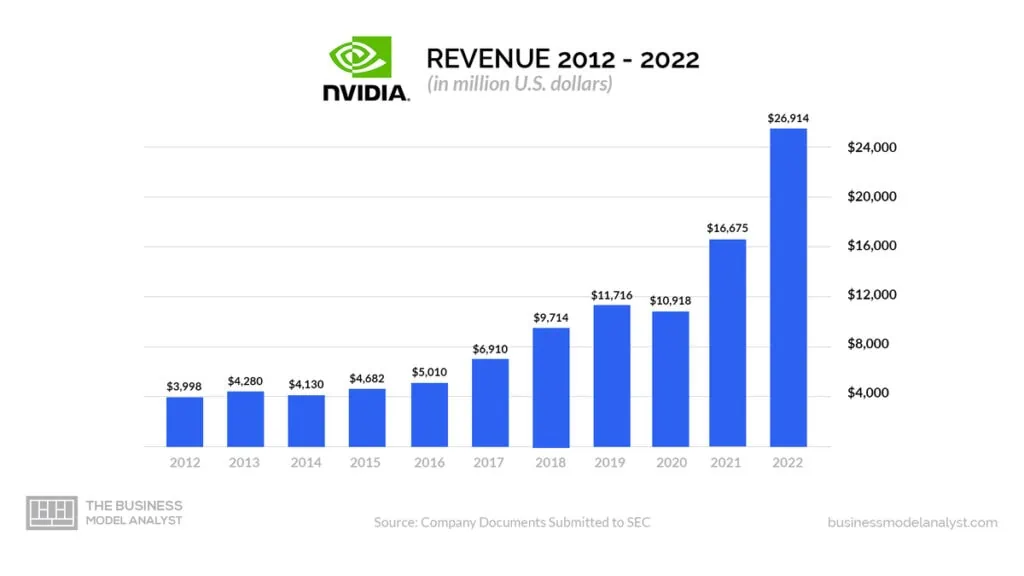

Revenue is a crucial component of NVIDIA's earnings time as it directly impacts the company's financial performance. Revenue is generated from the sale of NVIDIA's products and services, including graphics processing units (GPUs), gaming consoles, and data center solutions. Strong revenue growth indicates healthy demand for NVIDIA's products and services, which can positively impact the company's overall earnings.

For instance, in NVIDIA's fiscal 2023 first quarter, the company reported revenue of $8.29 billion, a significant increase from the previous quarter and year-over-year. This revenue growth was driven by strong demand for NVIDIA's GPUs from gaming, data center, and automotive customers. The increase in revenue contributed to NVIDIA's overall earnings growth and positively impacted its stock price.

Monitoring revenue trends during NVIDIA's earnings time provides investors and analysts with insights into the company's financial health, market share, and competitive positioning. It helps them assess the company's ability to generate revenue and drive. Furthermore, revenue performance can influence NVIDIA's research and development investments, product roadmap, and strategic decisions.

Earnings Per Share (EPS)

Earnings per share (EPS) is a crucial metric used to assess a company's financial performance and profitability. In the context of NVIDIA's earnings time, EPS provides insights into the company's ability to generate earnings on a per-share basis.

- EPS Calculation: EPS is calculated by dividing the company's net income by the number of common shares outstanding. It represents the portion of a company's profit allocated to each share of common stock.

- EPS Growth: Positive EPS growth indicates that the company is increasing its earnings per share over time. This can be driven by factors such as increased revenue, improved cost efficiency, or a reduction in the number of outstanding shares.

- EPS Impact on Stock Price: EPS growth can positively impact NVIDIA's stock price, as investors typically value companies with higher earnings per share. A strong EPS performance can boost investor confidence and lead to increased demand for NVIDIA's stock.

- EPS and Market Expectations: NVIDIA's EPS performance is often compared to analysts' estimates and market expectations. Meeting or exceeding these expectations can positively impact the stock price, while falling short of expectations can lead to a decline in share value.

Analyzing EPS during NVIDIA's earnings time provides valuable insights into the company's financial health, profitability, and overall performance. It helps investors and analysts assess NVIDIA's ability to generate earnings, evaluate its competitive position, and make informed investment decisions.

Gross Margin

Gross margin is a crucial metric that provides insights into NVIDIA's profitability and cost efficiency. It represents the percentage of revenue left after deducting the cost of goods sold (COGS) from revenue.

- Cost Structure: Gross margin is impacted by NVIDIA's cost structure, including manufacturing costs, materials, and labor expenses. A higher gross margin indicates that NVIDIA is able to control its costs effectively.

- Pricing Strategy: Gross margin can also be influenced by NVIDIA's pricing strategy. Higher prices can lead to increased gross margin, while lower prices may result in lower gross margin.

- Product Mix: The mix of products sold can affect gross margin. Products with higher margins contribute more to overall gross margin, while products with lower margins can reduce it.

- Competitive Landscape: Gross margin can be influenced by the competitive landscape. Intense competition can lead to lower prices and, consequently, lower gross margin.

Analyzing gross margin during NVIDIA's earnings time provides valuable insights into the company's cost structure, pricing strategy, product mix, and competitive positioning. It helps investors and analysts assess NVIDIA's ability to generate profits, evaluate its cost efficiency, and make informed investment decisions.

Forward-Looking Guidance

Forward-looking guidance, presented during NVIDIA's earnings time, holds significant importance as it provides insights into the company's expectations for the upcoming quarter. This guidance is a valuable tool for investors and analysts, enabling them to make informed decisions and assess NVIDIA's future prospects.

- Accuracy and Reliability: The accuracy of NVIDIA's forward-looking guidance is crucial. Accurate guidance builds trust and confidence among investors, while consistent inaccuracy can erode trust and lead to skepticism.

- Market Expectations: NVIDIA's forward-looking guidance is often compared to market expectations and analysts' estimates. Meeting or exceeding expectations can positively impact the stock price, while falling short can lead to a decline.

- Impact on Investment Decisions: Forward-looking guidance influences investment decisions. Positive guidance can encourage investors to buy or hold NVIDIA's stock, while negative guidance may lead to selling or reducing positions.

- Risk and Opportunity Assessment: Guidance helps investors assess potential risks and opportunities. It provides insights into NVIDIA's anticipated revenue, expenses, and profitability, allowing investors to make informed decisions about their investments.

Analyzing forward-looking guidance during NVIDIA's earnings time provides valuable insights into the company's strategic direction, financial planning, and overall outlook. It helps investors and analysts gauge NVIDIA's confidence in its future performance, evaluate its competitive positioning, and make informed investment decisions.

Analyst Expectations

Analyst expectations play a crucial role in shaping the market's response to NVIDIA's earnings time. These expectations, derived from analysts' research and industry knowledge, serve as a benchmark against which NVIDIA's actual results are compared.

- Accuracy and Impact: The accuracy of analyst expectations influences the market's reaction to NVIDIA's earnings report. Consistently accurate expectations enhance analysts' credibility, while persistent inaccuracies can erode trust.

- Market Sentiment: Analyst expectations reflect the overall market sentiment towards NVIDIA. Positive expectations can create a bullish atmosphere, attracting buyers and potentially driving up the stock price. Conversely, negative expectations can lead to a bearish outlook, encouraging selling and putting downward pressure on the stock price.

- Investment Decisions: Investors often use analyst expectations to make informed investment decisions. Expectations that align with or exceed NVIDIA's actual results can reinforce investors' confidence and encourage them to hold or buy the stock. On the other hand, expectations that fall short may trigger sell-offs or discourage new investments.

- Company Valuation: Analyst expectations contribute to the valuation of NVIDIA's stock. Expectations of strong future performance can lead to higher target prices and valuations, while expectations of weaker performance can result in lower valuations.

In conclusion, analyst expectations play a significant role in the context of NVIDIA's earnings time. They shape market sentiment, influence investment decisions, and contribute to the valuation of the company's stock. By understanding the dynamics between analyst expectations and NVIDIA's earnings results, investors can gain valuable insights into the market's perception of the company and make more informed investment decisions.

Market Reaction

The market reaction to NVIDIA's earnings release is a critical aspect of "NVIDIA earnings time" as it provides insights into investor sentiment and the overall perception of the company's financial performance.

A positive market reaction, characterized by a rise in NVIDIA's stock price, typically indicates that the company has exceeded market expectations and investors are optimistic about its future prospects. This positive sentiment can be attributed to factors such as strong revenue growth, improved profitability, and a positive outlook for the upcoming quarter.

Conversely, a negative market reaction, characterized by a decline in NVIDIA's stock price, suggests that the company has fallen short of expectations or that investors have concerns about its future prospects. This negative sentiment may stem from factors such as weaker-than-expected revenue, declining gross margins, or a cautious outlook for the upcoming quarter.

Understanding the market reaction to NVIDIA's earnings release is crucial for investors as it provides valuable information about the market's assessment of the company's performance and future prospects. By analyzing the market reaction in conjunction with the company's financial results, investors can make more informed investment decisions and assess the company's overall financial health and competitive positioning.

FAQs on NVIDIA Earnings Time

Question 1: What is the significance of NVIDIA's earnings time?

Answer: NVIDIA's earnings time is a crucial event that provides insights into the company's financial performance, revenue, and profitability. It allows investors, analysts, and the financial community to assess the company's overall financial health and make informed investment decisions.

Question 2: What are some key aspects to consider during NVIDIA's earnings time?

Answer: Key aspects to consider during NVIDIA's earnings time include revenue, earnings per share (EPS), gross margin, forward-looking guidance, analyst expectations, and market reaction. These aspects collectively provide a comprehensive view of NVIDIA's financial performance and future prospects.

Summary: NVIDIA's earnings time is a valuable event that provides investors, analysts, and the financial community with critical information to assess the company's financial health and make informed investment decisions. Understanding the significance and key aspects of NVIDIA's earnings time is essential for gaining insights into the company's performance and future prospects.

Conclusion

NVIDIA's earnings time provides a comprehensive view of the company's financial performance and future prospects. By analyzing key aspects such as revenue, earnings per share, gross margin, forward-looking guidance, analyst expectations, and market reaction, investors and analysts can gain valuable insights into NVIDIA's financial health, competitive positioning, and overall strategic direction.

Understanding NVIDIA's earnings time is crucial for informed investment decisions. The information presented during earnings time can help investors assess the company's ability to generate revenue, control costs, and deliver profitable growth. By staying informed about NVIDIA's earnings results and market reaction, investors can make sound investment decisions that align with their financial goals.

- Meg Nutt Onlyfans Leaks

- Zooemoore Leaked

- Mikafans Leaks

- Jasmine Sherni Fae Love Strictly Her Stepsister

- Mothers Warmth 3

Nvidia Earnings 2024 Time Vita Aloysia

Nvidia Earnings 2024 Time Limit Lilla Patrice

Nvidia Earnings 2024 Time Today Heida Kristan