Discover TDI Courtney: The Ultimate Solution For Your Business

TDI Courtney: A Leading Expert in TDI and Insurance

TDI Courtney is a highly respected expert in the insurance industry, with a particular focus on TDI (Total Disability Insurance). She has over 20 years of experience in the field and has helped countless individuals and families protect their financial security in the event of a disability.

TDI Courtney is a sought-after speaker and author on the topic of TDI. She has written extensively on the subject and has been featured in numerous publications. She is also a regular speaker at industry conferences and events.

TDI Courtney is a passionate advocate for TDI. She believes that everyone should have access to affordable, quality TDI coverage. She is committed to helping people understand the importance of TDI and to making sure that they have the coverage they need to protect their financial future.

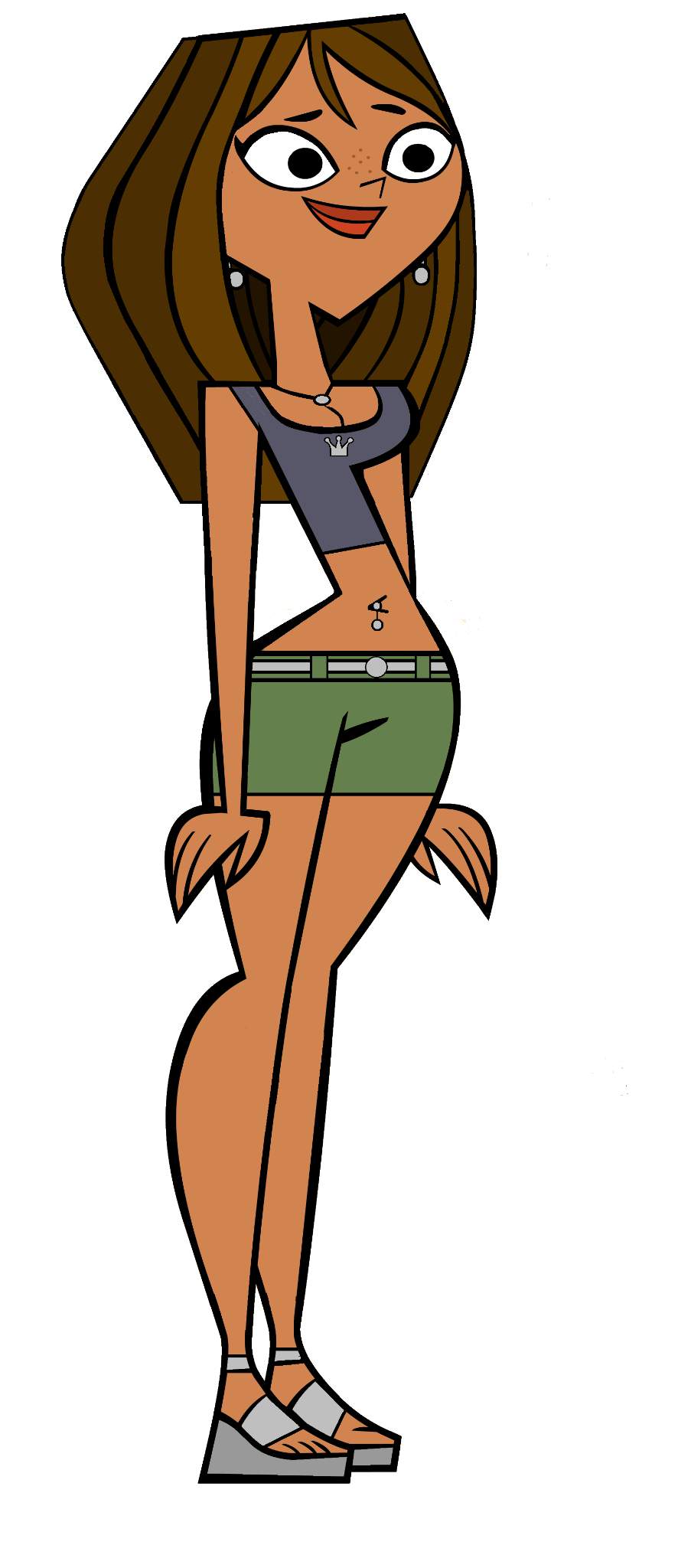

TDI Courtney

Understanding TDI: TDI provides financial protection in case of an accident or illness that prevents you from working. It is essential to understand the coverage you need and how it works.

Types of TDI: There are various types of TDI policies available, each with its own benefits and limitations. It is important to choose the policy that best meets your individual needs.

Applying for TDI: The application process for TDI can be complex. Courtney can guide you through the process and help you get the coverage you need.

Benefits of TDI: TDI can provide you with a financial safety net if you are unable to work due to a disability. It can help you pay for medical expenses, living expenses, and other costs.

TDI Courtney

Financial Protection: TDI provides financial protection in case you are unable to work due to a disability. It can help you pay for medical expenses, living expenses, and other costs.

Peace of Mind: TDI can give you peace of mind knowing that you and your family will be financially protected if you are unable to work.

Tax Benefits: TDI benefits are often tax-free, which can save you money.

- Does Douglas Murray Have A Partner

- Who Is Josh Allens Twin Brother

- Aurora Aksnes Relationships

- Masa49 Viral Mms

- Wentworth Earl Miller Ii

TDI Courtney

Start Early: The sooner you apply for TDI, the better. This will give you more time to secure coverage and avoid any potential delays.

Be Honest: When applying for TDI, it is important to be honest about your medical history. This will help the insurance company make an accurate assessment of your risk.

Get Help from an Expert: TDI Courtney can help you understand the TDI process and get the coverage you need.

TDI Courtney

TDI Courtney is a highly respected expert in the insurance industry, with a particular focus on Total Disability Insurance (TDI). She has over 20 years of experience in the field and has helped countless individuals and families protect their financial security in the event of a disability.

- Understanding TDI: TDI provides financial protection in case of an accident or illness that prevents you from working.

- Types of TDI: There are various types of TDI policies available, each with its own benefits and limitations.

- Applying for TDI: The application process for TDI can be complex. Courtney can guide you through the process and help you get the coverage you need.

- Benefits of TDI: TDI can provide you with a financial safety net if you are unable to work due to a disability.

- Importance of TDI: TDI can provide financial protection, peace of mind, and tax benefits.

- Tips for Getting TDI: Start early, be honest, and get help from an expert.

- TDI Courtney's Expertise: Courtney is a sought-after speaker and author on the topic of TDI.

These key aspects highlight the importance of TDI and the role that TDI Courtney plays in helping individuals and families protect their financial future. By understanding the different types of TDI, the application process, and the benefits of TDI, you can make informed decisions about your coverage. TDI Courtney's expertise and guidance can help you get the coverage you need to protect your financial security in the event of a disability.

Understanding TDI

Understanding TDI is crucial for anyone seeking financial protection against the risks associated with accidents or illnesses that could prevent them from working. TDI Courtney, an expert in the insurance industry, emphasizes the importance of understanding TDI and its benefits.

TDI provides a financial safety net, ensuring individuals and families can continue to meet their financial obligations even if they are unable to work due to a disability. TDI policies cover a range of expenses, including medical bills, living expenses, and other costs.

TDI Courtney's expertise lies in guiding individuals through the complexities of TDI coverage. She helps them understand the different types of TDI policies, the application process, and the benefits of TDI. By understanding TDI, individuals can make informed decisions about their coverage and ensure they have the necessary protection in place.

Understanding TDI is not only important for individuals but also for employers and policymakers. Employers can provide TDI coverage as part of their employee benefits packages, offering financial protection to their workforce. Policymakers can develop and implement regulations that ensure access to affordable and comprehensive TDI coverage for all citizens.

In conclusion, understanding TDI is essential for financial security and risk management. TDI Courtney's expertise in this area empowers individuals, families, employers, and policymakers to make informed decisions and protect against the financial consequences of disability.

Types of TDI

Understanding the different types of TDI policies is crucial for choosing the coverage that best meets your individual needs. TDI Courtney, an expert in the insurance industry, can guide you through the various types of TDI policies and help you make an informed decision.

There are two main types of TDI policies: individual and group. Individual TDI policies are purchased by individuals and provide coverage for the policyholder. Group TDI policies are purchased by employers and provide coverage for employees.

Within these two main types of TDI policies, there are a variety of different options available. Some of the most common types of TDI policies include:

- Short-term disability insurance: This type of TDI policy provides coverage for a limited period of time, typically up to two years.

- Long-term disability insurance: This type of TDI policy provides coverage for a longer period of time, typically up to five years or even longer.

- Own-occupation disability insurance: This type of TDI policy provides coverage if you are unable to work in your own occupation, even if you are able to work in another occupation.

- Any-occupation disability insurance: This type of TDI policy provides coverage if you are unable to work in any occupation, regardless of your training or experience.

Each type of TDI policy has its own benefits and limitations. It is important to compare the different types of policies and choose the one that best meets your individual needs.

TDI Courtney can help you understand the different types of TDI policies and choose the one that is right for you. She can also help you apply for TDI coverage and ensure that you get the benefits you deserve.

Applying for TDI

Applying for TDI can be a complex and challenging process, but TDI Courtney can guide you through the process and help you get the coverage you need. Here are a few reasons why you should consider working with TDI Courtney when applying for TDI:

- Expertise and Experience: TDI Courtney has over 20 years of experience in the insurance industry, and she is an expert in TDI. She knows the ins and outs of the TDI application process, and she can help you avoid common mistakes that could delay or even deny your claim.

- Personalized Guidance: TDI Courtney will work with you one-on-one to understand your individual needs and circumstances. She will help you choose the right TDI policy and guide you through the application process from start to finish.

- Advocacy and Support: If your TDI claim is denied, TDI Courtney will advocate on your behalf and help you appeal the decision. She will fight for your rights and ensure that you get the benefits you deserve.

If you are considering applying for TDI, TDI Courtney can help you get the coverage you need. Contact her today to learn more about her services.

Benefits of TDI

Total Disability Insurance (TDI) offers a crucial financial safety net for individuals who are unable to work due to a disability. TDI Courtney, a leading expert in the field, highlights the significance of TDI and its benefits, empowering individuals to protect their financial future in the event of unforeseen circumstances.

- Financial Protection: TDI provides a financial lifeline in case of a disability, ensuring individuals can continue meeting their financial obligations, such as mortgage payments, utility bills, and living expenses.

- Peace of Mind: TDI offers peace of mind, knowing that financial security is maintained even if a disability prevents an individual from working. This allows individuals to focus on their recovery and well-being without the added stress of financial burdens.

- Income Replacement: TDI provides income replacement, ensuring individuals can continue to support themselves and their families, even if their regular income is interrupted due to a disability.

- Tax Benefits: TDI benefits are often tax-free or tax-advantaged, providing additional financial relief during a challenging time.

TDI Courtney's expertise extends to guiding individuals through the complexities of TDI coverage, ensuring they understand the different types of policies, eligibility criteria, and application processes. By leveraging her knowledge and experience, TDI Courtney empowers individuals to make informed decisions about their TDI coverage, safeguarding their financial well-being in the face of adversity.

Importance of TDI

Total Disability Insurance (TDI) plays a pivotal role in safeguarding financial well-being in the face of unforeseen circumstances. TDI Courtney, a respected insurance expert, emphasizes the significance of TDI's benefits, empowering individuals to make informed decisions about their financial future.

- Financial Protection:

TDI provides a financial lifeline, ensuring individuals can meet their financial obligations, such as mortgage payments, utility bills, and living expenses, even if a disability prevents them from working. TDI Courtney's guidance helps individuals understand the different types of TDI policies and coverage options, ensuring they have adequate protection in place.

- Peace of Mind:

TDI offers peace of mind, knowing that financial security is maintained despite a disability. TDI Courtney's expertise extends to providing personalized advice, helping individuals navigate the complexities of TDI coverage and ensuring they have the necessary support during challenging times.

- Tax Benefits:

TDI benefits are often tax-free or tax-advantaged, providing additional financial relief during a time of need. TDI Courtney stays up-to-date on the latest tax regulations and can advise individuals on maximizing their tax savings through strategic TDI planning.

TDI Courtney's commitment to TDI stems from her deep understanding of its transformative impact on individuals and families. By empowering individuals with knowledge and tailored guidance, TDI Courtney enables them to safeguard their financial future and focus on their recovery and well-being in the event of a disability.

Tips for Getting TDI

In the realm of Total Disability Insurance (TDI), following these tips can significantly enhance your chances of securing coverage and maximizing benefits. TDI Courtney, an esteemed expert in the field, emphasizes the importance of these tips and provides valuable insights to help you navigate the TDI landscape.

- Start Early:

Applying for TDI promptly allows ample time for thorough assessment and processing of your application. TDI Courtney advises starting the process as early as possible to avoid potential delays or complications. Early application demonstrates your foresight and preparedness, increasing the likelihood of a smooth and successful outcome.

- Be Honest:

Transparency and accuracy are crucial when applying for TDI. Disclose all relevant medical information truthfully to ensure a fair and accurate assessment of your eligibility. TDI Courtney stresses the importance of honesty, as any misrepresentation or omission can jeopardize your claim.

- Get Help from an Expert:

Navigating the intricacies of TDI can be daunting. Seeking guidance from an expert like TDI Courtney can provide invaluable support. They can help you understand the different types of TDI policies, assess your needs, and tailor a strategy to maximize your coverage. Their expertise and experience can significantly increase your chances of obtaining the protection you need.

By adhering to these tips and leveraging the expertise of TDI Courtney, you can enhance your chances of securing comprehensive TDI coverage. This financial safety net can provide peace of mind and protect your financial well-being in the event of a disability.

TDI Courtney's Expertise

TDI Courtney's expertise in Total Disability Insurance (TDI) is widely recognized, making her a sought-after speaker and author on the subject. Her extensive knowledge and experience in the field empower her to deliver valuable insights and guidance to individuals and organizations seeking to navigate the complexities of TDI.

- Thought Leadership:

Courtney is a respected thought leader in the TDI industry. Her presentations and publications are highly regarded for their depth of knowledge, practical insights, and actionable recommendations. She regularly speaks at conferences and seminars, sharing her expertise with professionals and consumers alike.

- Educational Resources:

Courtney is committed to educating individuals about TDI and its importance. She has authored numerous articles, white papers, and books on the subject, providing comprehensive and accessible resources for those seeking to understand TDI.

- Policy Analysis:

Courtney closely monitors legislative and regulatory developments related to TDI. Her analysis of proposed changes and emerging trends helps individuals and organizations stay informed and make informed decisions about their TDI coverage.

- Advocacy and Awareness:

Courtney is a passionate advocate for TDI. She actively participates in industry organizations and collaborates with policymakers to raise awareness about the importance of TDI and ensure its accessibility to those who need it.

TDI Courtney's expertise and dedication have significantly contributed to the advancement of TDI knowledge and understanding. Her thought leadership, educational resources, policy analysis, and advocacy efforts empower individuals and organizations to make informed decisions about their financial security in the event of a disability.

FAQs on Total Disability Insurance (TDI)

Total Disability Insurance (TDI) is a crucial financial protection against the risks associated with disabilities that prevent individuals from working. Here are answers to some frequently asked questions (FAQs) about TDI:

Question 1: What exactly is covered under TDI?

Answer: TDI policies typically cover a range of expenses incurred due to a qualifying disability, including medical bills, living expenses, and lost income. The specific benefits and coverage limits vary depending on the policy and provider.

Question 2: How do I determine if I am eligible for TDI?

Answer: Eligibility for TDI usually requires meeting certain criteria, such as having worked a minimum number of hours or earning a certain income level. Individuals should refer to the specific policy or consult with an insurance professional to confirm their eligibility.

Summary: Understanding TDI and its benefits is essential for individuals seeking financial security against disabilities. These FAQs provide a starting point for exploring TDI and making informed decisions about coverage options.

TDI Courtney

TDI Courtney has emerged as a renowned expert in Total Disability Insurance (TDI), providing invaluable guidance and support to individuals seeking financial protection against disabilities. Her expertise encompasses a deep understanding of TDI policies, industry trends, and best practices.

Through her extensive experience, Courtney has empowered countless individuals and families to safeguard their financial well-being in the face of unforeseen circumstances. Her commitment to education and advocacy has raised awareness about the significance of TDI, ensuring its accessibility to those who need it most.

Courtney Total Drama Wiki Fandom

Courtney's New Look Total Drama Official Amino

courtney Total drama island, Favorite character, Drama