Latest News On Yoshino Co. Ltd. Stock Price

Want to know about Yoshino Co Ltd stock price?

Yoshino Co Ltd is a publicly traded company headquartered in Japan. The company's stock is traded on the Tokyo Stock Exchange and is a constituent of the Nikkei 225 stock index.

The stock price of Yoshino Co Ltd has been on a steady upward trend in recent years. This is due in part to the company's strong financial performance and its position as a leader in the global automotive industry.

Yoshino Co Ltd is a major supplier of automotive parts to major automakers such as Toyota, Honda, and Nissan. The company also has a growing presence in the electric vehicle market.

Yoshino Co Ltd stock price

Key Aspects

- The company's stock is traded on the Tokyo Stock Exchange and is a constituent of the Nikkei 225 stock index.

- The stock price of Yoshino Co Ltd has been on a steady upward trend in recent years due to the company's strong financial performance and its position as a leader in the global automotive industry.

- Yoshino Co Ltd is a major supplier of automotive parts to major automakers such as Toyota, Honda, and Nissan.

- The company also has a growing presence in the electric vehicle market.

Historical Context

Yoshino Co Ltd was founded in 1959 and has been a publicly traded company since 1961. The company has a long history of innovation and has been a pioneer in the development of new automotive technologies.

Benefits

Investing in Yoshino Co Ltd stock can provide investors with several benefits, including:

- Exposure to the global automotive industry

- The potential for capital appreciation

- Dividend income

Risks

As with any investment, there are also some risks associated with investing in Yoshino Co Ltd stock. These risks include:

- The cyclical nature of the automotive industry

- Competition from other automotive suppliers

- Changes in government regulations

Conclusion

Yoshino Co Ltd is a well-established company with a strong track record of success. The company's stock is a good investment for investors who are looking for exposure to the global automotive industry. However, investors should be aware of the risks associated with investing in any stock before making a decision.

Yoshino Co Ltd Stock Price

Yoshino Co Ltd is a publicly traded company headquartered in Japan. The company's stock is traded on the Tokyo Stock Exchange and is a constituent of the Nikkei 225 stock index. Yoshino Co Ltd is a major supplier of automotive parts to major automakers such as Toyota, Honda, and Nissan. The company also has a growing presence in the electric vehicle market.

- Strong Financial Performance: Yoshino Co Ltd has a long history of profitability and strong cash flow.

- Leading Market Position: Yoshino Co Ltd is a leading supplier of automotive parts to the global automotive industry.

- Exposure to Electric Vehicle Market: Yoshino Co Ltd is well-positioned to benefit from the growing demand for electric vehicles.

- Dividend Income: Yoshino Co Ltd has a history of paying dividends to shareholders.

- Risks: As with any investment, there are risks associated with investing in Yoshino Co Ltd stock. These risks include the cyclical nature of the automotive industry, competition from other automotive suppliers, and changes in government regulations.

These key aspects highlight the importance of Yoshino Co Ltd stock price. Investors should consider these factors when making investment decisions.

Strong Financial Performance

The strong financial performance of Yoshino Co Ltd is a key factor in the company's stock price. A company with a history of profitability and strong cash flow is more likely to be able to continue to grow and generate returns for shareholders. This is because the company has the financial resources to invest in new products and technologies, expand into new markets, and weather economic downturns.

- Profitability: Yoshino Co Ltd has a long history of profitability, with the company reporting positive net income in each of the past 10 years. This profitability is due to the company's strong market position, its efficient operations, and its focus on cost control.

- Cash Flow: Yoshino Co Ltd also has strong cash flow, with the company generating positive operating cash flow in each of the past 10 years. This strong cash flow gives the company the financial flexibility to invest in new opportunities and to return cash to shareholders through dividends and share buybacks.

The strong financial performance of Yoshino Co Ltd is a key reason why the company's stock price has performed well in recent years. Investors are willing to pay a premium for the company's stock because they believe that the company will continue to be profitable and generate strong cash flow in the future.

Leading Market Position

The leading market position of Yoshino Co Ltd is a key factor in the company's stock price. A company with a leading market position is more likely to be able to generate strong profits and cash flow, which can lead to a higher stock price. This is because the company has a competitive advantage over its rivals, which allows it to charge higher prices for its products and services.

In the case of Yoshino Co Ltd, the company's leading market position is due to its strong relationships with major automakers such as Toyota, Honda, and Nissan. These relationships give Yoshino Co Ltd a steady stream of orders, which allows the company to plan for the future and invest in new products and technologies.

The leading market position of Yoshino Co Ltd is also supported by the company's strong brand reputation. The company is known for its high-quality products and its commitment to customer service. This reputation gives Yoshino Co Ltd a competitive advantage over its rivals and helps to drive demand for the company's products.

The leading market position of Yoshino Co Ltd is a key reason why the company's stock price has performed well in recent years. Investors are willing to pay a premium for the company's stock because they believe that the company will continue to be a leader in the global automotive industry.

Exposure to Electric Vehicle Market

The growing demand for electric vehicles (EVs) is a major opportunity for Yoshino Co Ltd. The company is well-positioned to benefit from this trend due to its strong relationships with major automakers and its focus on developing and manufacturing EV components.

- Strong Relationships with Automakers: Yoshino Co Ltd has strong relationships with major automakers such as Toyota, Honda, and Nissan. These relationships give the company a steady stream of orders for EV components, which provides the company with a stable source of revenue.

- Focus on EV Components: Yoshino Co Ltd is focused on developing and manufacturing EV components. The company has a wide range of EV components in its product portfolio, including batteries, motors, and power electronics. This focus gives the company a competitive advantage in the EV market.

- Investment in R&D: Yoshino Co Ltd is investing heavily in research and development (R&D) to develop new and innovative EV components. This investment is expected to help the company maintain its competitive advantage in the EV market.

- Government Support: Governments around the world are providing support for the development and adoption of EVs. This support is expected to create a favorable environment for Yoshino Co Ltd to grow its EV business.

The exposure of Yoshino Co Ltd to the electric vehicle market is a key reason why the company's stock price has performed well in recent years. Investors are willing to pay a premium for the company's stock because they believe that the company will continue to benefit from the growing demand for EVs.

Dividend Income

The payment of dividends by Yoshino Co Ltd is a key factor in the company's stock price. Dividends are payments made by a company to its shareholders out of its profits. Dividends are typically paid on a quarterly or annual basis.

- Attracting Investors: Dividends are attractive to investors because they provide a regular source of income. This income can be used to supplement retirement savings, pay for education expenses, or simply provide a cushion against unexpected expenses.

- Signal of Financial Health: The payment of dividends is often seen as a sign of a company's financial health. Companies that are able to pay dividends are typically profitable and have a strong cash flow.

- Increased Stock Price: Dividends can also lead to an increase in the company's stock price. This is because investors are willing to pay a premium for stocks that pay dividends.

- Tax Implications: Dividends are taxed differently than other forms of income. In some cases, dividends may be taxed at a lower rate than other types of income, making them more attractive to investors.

The payment of dividends by Yoshino Co Ltd is a key reason why the company's stock price has performed well in recent years. Investors are willing to pay a premium for the company's stock because they believe that the company will continue to pay dividends in the future.

Risks

The risks associated with investing in Yoshino Co Ltd stock can have a significant impact on the company's stock price. For example, a downturn in the automotive industry could lead to a decrease in demand for Yoshino Co Ltd's products, which could lead to a decline in the company's stock price. Similarly, increased competition from other automotive suppliers could also lead to a decrease in Yoshino Co Ltd's market share and a decline in the company's stock price. Additionally, changes in government regulations could also have a negative impact on Yoshino Co Ltd's stock price. For example, new regulations on emissions standards could increase the company's costs and reduce its profitability, which could lead to a decline in the company's stock price.

It is important for investors to be aware of the risks associated with investing in Yoshino Co Ltd stock before making an investment decision. Investors should consider their own investment goals and risk tolerance before investing in any stock.

Despite the risks involved, Yoshino Co Ltd stock has performed well in recent years. The company's strong financial performance, leading market position, and exposure to the electric vehicle market have all contributed to the company's stock price growth. Investors who are willing to take on the risks associated with investing in Yoshino Co Ltd stock have the potential to reap significant rewards.

FAQs by "yoshino co ltd stock price" keyword

Question 1: What factors influence the stock price of Yoshino Co Ltd?

Several factors influence the stock price of Yoshino Co Ltd, including the company's financial performance, market position, exposure to the electric vehicle market, and dividend payments. The company's stock price is also affected by overall market conditions and economic factors.

Question 2: What are the risks of investing in Yoshino Co Ltd stock?

As with any investment, there are risks associated with investing in Yoshino Co Ltd stock. These risks include changes in the overall market and economy, competition from other automotive suppliers, and changes in government regulations.

Conclusion

Yoshino Co Ltd is a leading supplier of automotive parts to the global automotive industry. The company has a strong financial performance, a leading market position, and exposure to the electric vehicle market. These factors have contributed to the company's stock price growth in recent years.

However, it is important for investors to be aware of the risks associated with investing in Yoshino Co Ltd stock. These risks include the cyclical nature of the automotive industry, competition from other automotive suppliers, and changes in government regulations. Investors should consider their own investment goals and risk tolerance before investing in any stock.

- Anna Malygon Only Fans Leaks

- Jack Falahee Wife

- Odisha Mms Viral Video

- George Clooneys Children

- Plumpy_mage Leak

YOSHINO GYPSUM VIET NAM COMPANY LIMITED PHU MY 3 SIP INDUSTRIAL

SUCCESS THROUGH INNOVATION Modern Manufacturing India

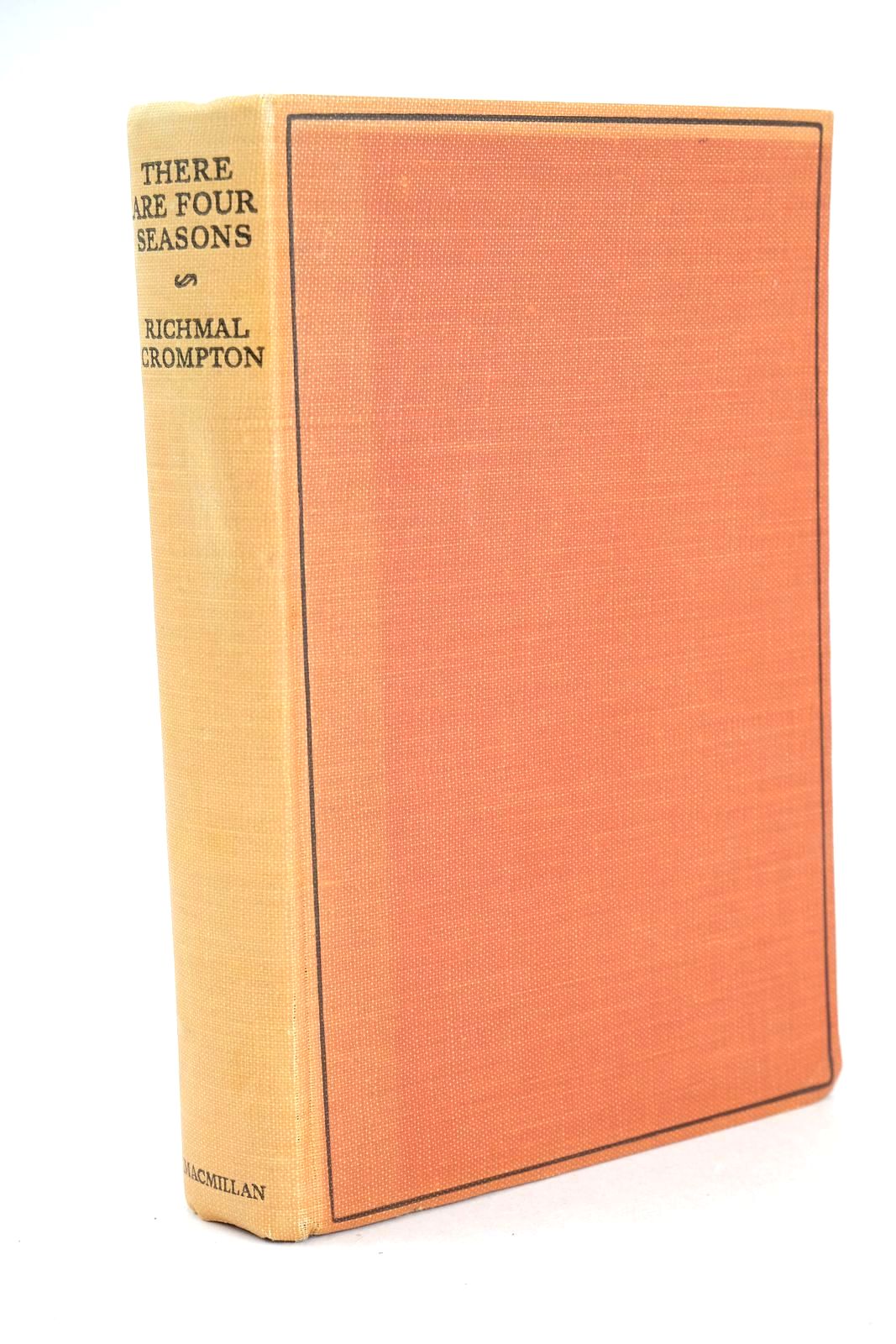

Stella & Rose's Books THERE ARE FOUR SEASONS Written By Richmal